Discover why it’s essential to report a foreign gift this year

Every little thing You Required to Know About Coverage a Foreign Present: A Comprehensive Overview

Coverage international gifts is a vital aspect for united state institutions. Recognizing the lawful demands and the implications of non-compliance is essential for keeping stability. Establishments must navigate complex reporting thresholds and due dates. Proper paperwork plays a vital duty in this procedure. As the landscape of international contributions progresses, organizations have to adapt their techniques accordingly. What are the most effective methods to assure compliance and openness?

Recognizing International Gifts: Interpretation and Extent

While numerous institutions may receive various types of support, comprehending foreign presents requires a clear definition and extent. Foreign presents refer to any kind of products, funds, or services given by foreign entities, individuals, or federal governments to U.S. establishments. These gifts can be available in numerous types, consisting of money contributions, residential property, research financing, and scholarships.

The range of foreign presents includes not only direct financial backing yet likewise in-kind contributions that may affect the institution's procedures or research priorities. It is vital for institutions to recognize the implications of accepting such gifts, as they may lug details conditions or assumptions from the donor. Understanding the subtleties of foreign gifts help companies in maintaining transparency and responsibility while cultivating global relationships. Inevitably, a comprehensive grasp of international gifts is essential for establishments to navigate the intricacies of funding and support their stability in the scholastic and research area.

Lawful Demands for Reporting Foreign Gifts

In addition, government regulations might demand openness concerning the sources of financing, especially if linked to sensitive research study locations. Establishments have to maintain accurate documents of international presents, assuring they can validate reported payments during audits. This procedure frequently requires collaboration amongst numerous institutional departments, including money, legal, and conformity teams, to ensure adherence to both federal standards and institutional policies. Recognizing these legal structures is essential for establishments to effectively handle and report international gifts.

Secret Reporting Thresholds and Deadlines

Establishments should be aware of particular reporting target dates and thresholds to verify conformity with policies regarding international gifts. The U.S. Division of Education and learning requires establishments to report any international presents exceeding $250,000 within a fiscal year. This threshold incorporates both individual gifts and collective contributions from a solitary international resource.

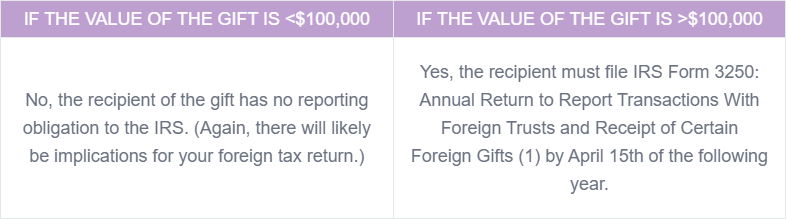

Furthermore, institutions must report any type of international presents surpassing $100,000 to the Foreign Representatives Enrollment Act (FARA) if the gifts are linked to lobbying or political tasks.

Target dates for reporting are necessary; organizations are commonly required to submit annual reports by July 31 for presents gotten during the previous monetary year. Failing to fulfill these thresholds or target dates might lead to charges, consisting of loss of federal funding. Because of this, establishments should establish a persistent surveillance and reporting process to ensure adherence to these important policies.

How to Appropriately Paper and Report Foreign Present

Proper documentation and reporting of foreign gifts require a clear understanding of the needed compliance procedures. This includes sticking to a needed paperwork list and following established coverage treatments. Legal considerations must additionally be thought about to assure full conformity with applicable laws.

Needed Paperwork Checklist

When reporting international presents to establish conformity with governing demands, precise paperwork is essential. Institutions have to maintain a thorough record of each present, consisting of the contributor's name, the amount or worth of the present, and the date it was obtained. Additionally, a description of the objective of the gift and any type of constraints imposed by the benefactor should be documented. Document with the donor, such as letters or emails, can offer context and confirmation. It is likewise essential to consist of any relevant contracts or agreements. Financial documents, such as bank declarations or invoices, need to support the worth of the gift. Appropriate organization and retention of these records will help with the reporting procedure and assurance adherence to guidelines.

Reporting Procedures Overview

When steering the complexities of reporting foreign gifts, it is essential to comply with well-known treatments to guarantee conformity with governing standards. Organizations has to start by recognizing the nature and value of the present, making certain exact documentation. This includes putting together receipts, contributor communication, and any type of appropriate contracts. Next, entities must send the required forms to the suitable governmental bodies, commonly consisting of the Department of Education and learning or other marked firms. It is critical to stick to target dates, as tardy submissions may bring about penalties. In addition, maintaining detailed documents of the reporting procedure is crucial for future audits. Organizations should train their personnel on these treatments to assure regular compliance across all divisions.

Compliance and Lawful Considerations

Just how can companies ensure they fulfill compliance and lawful requirements when documenting international presents? To establish adherence, organizations should establish an extensive coverage structure that consists of clear interpretations of international presents and limits for reporting needs. Accurate paperwork is necessary, demanding in-depth records of the present's source, worth, and function. Organizations must implement internal policies for prompt reporting to appropriate authorities, including government firms, as stipulated by the Foreign Gifts and Contracts Disclosure Act. Educating team on conformity methods and maintaining open lines of interaction with lawful advise can better boost adherence. Normal audits of international present documentation practices will certainly aid determine possible compliance gaps, guaranteeing organizations copyright legal requirements while promoting openness in their financial relationships.

Consequences of Non-Compliance in Coverage

Failing to abide by international gift reporting needs can lead to considerable lawful charges for organizations. Additionally, non-compliance may taint an establishment's track record, threatening trust with stakeholders. Comprehending these effects is necessary for keeping both honest and legal criteria.

Legal Charges for Non-Compliance

Non-compliance in reporting international gifts can bring about substantial legal charges that may adversely influence organizations and individuals alike. The Federal government purely enforces guidelines surrounding international payments, and infractions can lead to severe consequences, consisting of hefty penalties. Institutions might encounter charges getting to hundreds of bucks for each and every instance of non-compliance, depending upon the quantity of the unreported present. Furthermore, people associated with the reporting procedure might experience individual obligations, consisting of fines or possible criminal charges for unyielding neglect. Additionally, the potential for audits rises, causing more analysis of economic methods. In general, understanding click over here and sticking to reporting requirements is crucial to stay clear of these serious legal ramifications and guarantee compliance with federal policies.

Effect On Institutional Reputation

While legal penalties are a significant worry, the effect on an institution's track record can be just as profound when it pertains to stopping working to report international presents. Non-compliance can bring about public suspect, harmful partnerships with stakeholders, graduates, and prospective contributors. Institutions run the risk of being perceived as undependable or lacking openness, which can hinder future funding possibilities. Additionally, adverse media protection might enhance these issues, causing a resilient tarnish on the establishment's picture. This erosion of credibility can have far-reaching effects, including lowered enrollment, challenges in employment, and weakened collaborations with other academic or study organizations. Ultimately, the anchor failure to abide by reporting demands not just endangers economic security however additionally endangers the stability and reputation of the organization itself.

Finest Practices for Managing Foreign Presents in Establishments

Efficiently managing foreign presents in establishments requires a structured technique that focuses on openness and conformity. Organizations need to establish clear plans laying out the approval, reporting, and use of international presents. A devoted board can manage these policies, ensuring they line up with both regulatory demands and institutional worths.

Normal training for team associated with present monitoring is important to keep recognition of conformity responsibilities and moral factors to consider. Establishments should carry out thorough due diligence on prospective international benefactors to assess any potential risks connected with accepting their gifts.

Additionally, open communication with stakeholders, consisting of faculty and students, fosters trust and reduces concerns relating to international influences. Regular audits of foreign gift transactions can help identify any kind of inconsistencies and support liability. By carrying out these ideal practices, organizations can efficiently browse the complexities of getting foreign gifts while safeguarding their honesty and online reputation.

Regularly Asked Questions

What Kinds Of Foreign Present Are Excluded From Reporting?

Can Foreign Gifts Be Utilized for Individual Expenditures?

Foreign presents can not be utilized for individual expenses. They are meant for details objectives, commonly relevant to educational or institutional assistance, and mistreating them for individual gain might bring about lawful and moral repercussions.

Are There Fines for Late Reporting of Foreign Gifts?

Yes, charges can be enforced for late coverage of foreign gifts. These might include penalties or restrictions on future financing. Prompt conformity is important to avoid possible legal and financial repercussions related to such coverage needs.

How Do Foreign Presents Impact Tax Obligations?

Foreign gifts might influence tax obligations by possibly going through reporting requirements and, sometimes, tax. Recipients must divulge these presents to ensure conformity with internal revenue service regulations and stay clear of fines or unexpected tax liabilities.

Can Organizations Refuse International Gifts Without Coverage?

Establishments can decline foreign gifts without reporting them, as there is no responsibility to accept donations. report a foreign gift. If accepted, they have to stick to regulative needs pertaining to disclosure and potential ramifications on tax obligation obligations.